Because Coverage Should Include Value.

Your auto insurance pays for repairs — but not the $5,000+ in lost resale value after an accident.

LossPay protects what traditional insurance leaves behind.

How It Works

Choose Your Coverage

Select a monthly plan based on your car’s value and your loan or lease status.

Get Repaired, File Zero Paperwork

If your vehicle is in an accident and repaired, LossPay automatically calculates your diminished value.

Receive Your Payout

We pay you the lost equity — fast, fairly, and without the legal battle.

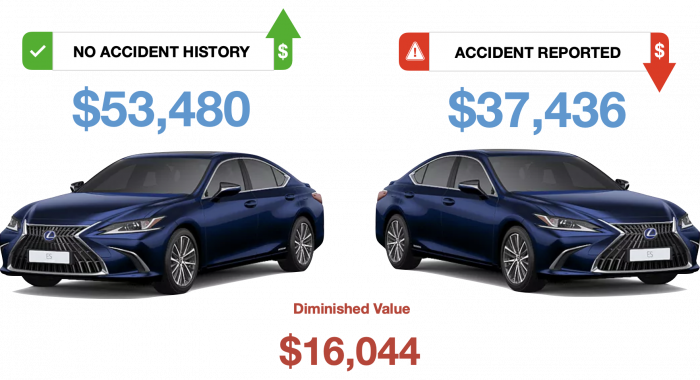

The Hidden Loss No One Told You About

After a collision, your car loses 15–30% of its value. Even after repairs.

That’s diminished value — and it’s almost never covered by your insurer.

LossPay is the first insurance product built to close that gap. We protect your equity — not just your car.

Who It’s For

- Drivers with new or financed vehicles

- Luxury or high-resale car owners

- Leaseholders who want to avoid return penalties

- Anyone who wants to protect the full value of their vehicle

Why LossPay

| Feature | Traditional Insurance | LossPay |

|---|---|---|

| Repairs Paid For | ✅ | ✅ |

| Resale Value Protected | ❌ | ✅ |

| Preemptive Coverage | ❌ | ✅ |

| Fast Payouts | ❌ | ✅ |

| Affordable Monthly Premium | ❌ | ✅ |

Real-World Example:

Accident repair covered: $4,200

Trade-in value lost: $6,800

LossPay payout: $6,800 — no hassle, no lawyer, no delay.

You already protect the car. Now protect its value.

LossPay is the final layer of true protection — because coverage should include value.

- 60-second quote

- No impact to credit

- Cancel anytime

FAQ

Doesn’t my insurance already cover this?

No. Standard auto policies only cover the cost to repair, not the loss in resale value.

How much does it cost?

Plans start at $16/month and vary by vehicle value.

Can I buy it after an accident?

No. Like all real insurance, coverage must be active before the loss.